Crypto Loan

Overview

The Crypto Loan project aims to provide users with a simple and flexible way to unlock liquidity from their crypto assets without having to sell them. By using crypto as collateral, users can borrow funds quickly while maintaining their long-term positions.

This initiative supports our broader goal of expanding the utility of crypto assets, offering more ways for users to manage and access value on the platform.

Role

I led the end-to-end design of the crypto loan feature as the sole designer on the project. From user research and competitive analysis to wireframes, visual design, and prototyping, I owned the entire UX/UI process and collaborated closely with product and engineering to bring the experience to life.

Duration

3 months

Skills

Research, Strategy, Wireframe, Prototyping, Testing, UI Design

Problem

Crypto users often need fast access to liquidity without selling their assets, especially during periods of high market volatility. Whether it’s to protect an existing position, seize a sudden investment opportunity, or avoid forced selling. There’s a need for a simple and responsive borrowing experience that gives users greater control and speed when it matters most.

User Research & Competitor Analysis

Key Insights from User Research

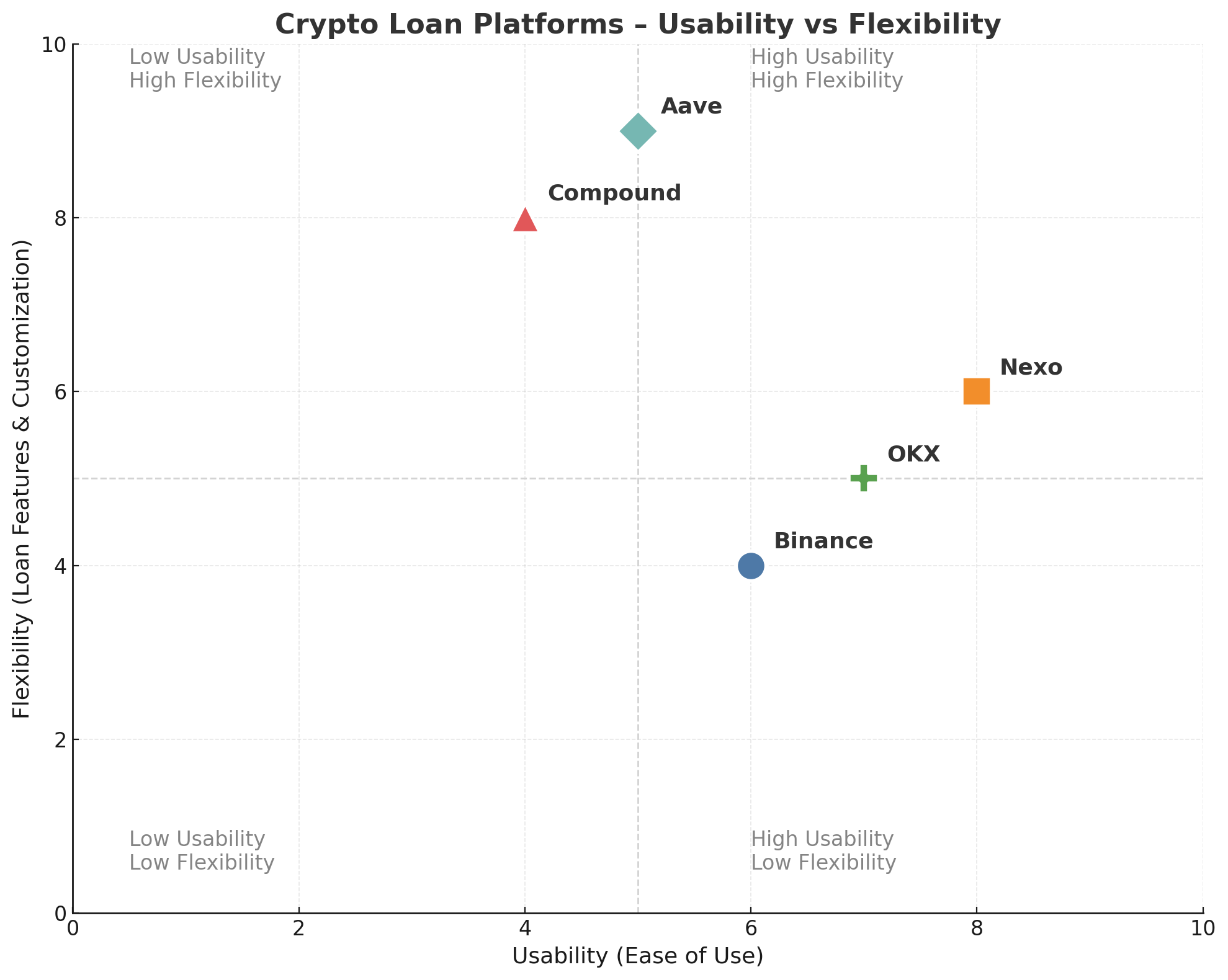

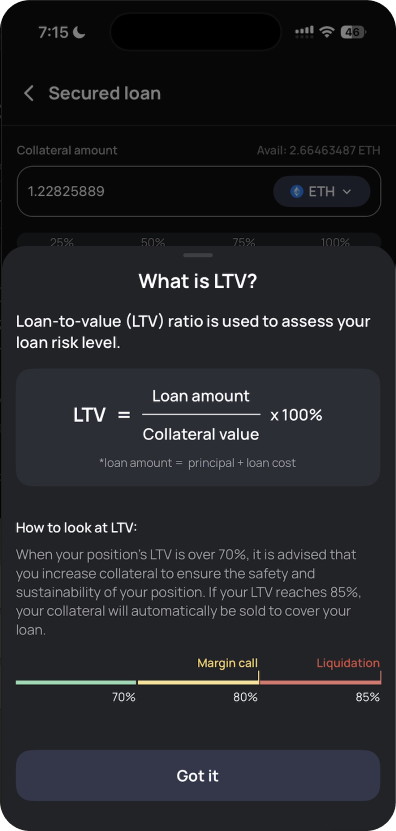

Users often feel unsure about how loan-to-value (LTV) works or how close they are to liquidation.

Fixed LTV settings make users unaware of risk levels and limit their flexibility to adjust borrowing based on market conditions or personal needs.

Simpler flows and clearer terms (interest, repayment, risk) increased confidence in using loan products.

Many users seek quick liquidity during volatile markets, either to prevent liquidation elsewhere or capitalize on short-term opportunities.

Most platforms lack real-time LTV feedback and are too technical for mainstream users.

Some have rigid LTV tiers, while others don’t explain liquidation thresholds clearly.

Very few support easy loan adjustment or collateral top-ups mid-loan.

Very few support easy loan adjustment or collateral top-ups mid-loan.

Key Competitive Analysis

Objective

Design a borrowing experience that’s fast, flexible, and easy to understand, empowering users to access liquidity confidently while maintaining clear visibility into cost and risk.

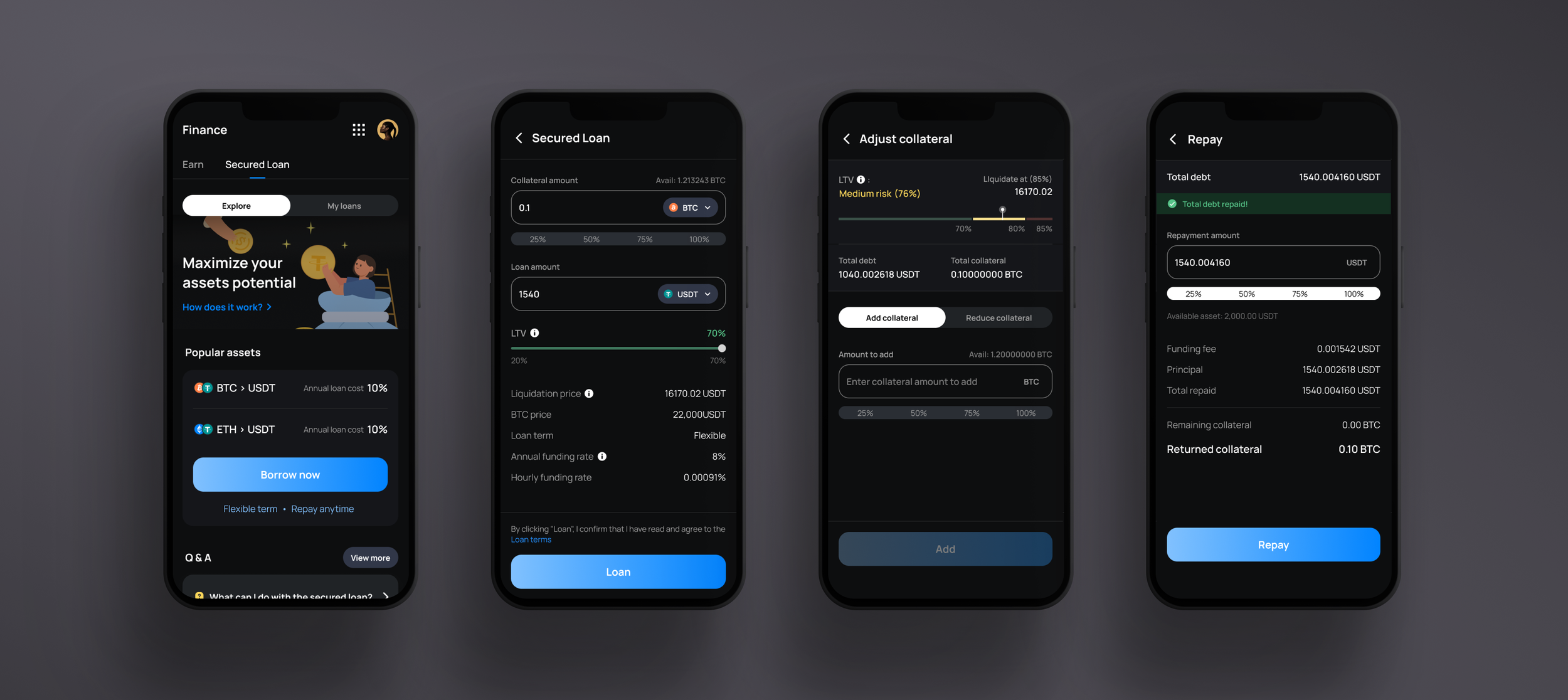

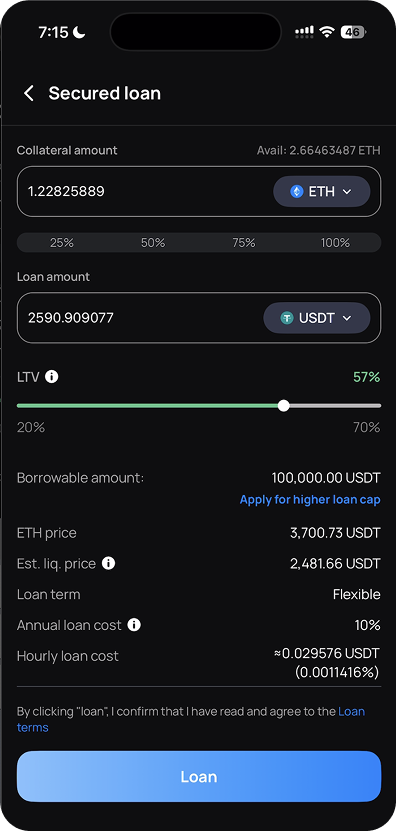

Start Loan

We tested multiple interaction models (slider, percentage buttons, manual input) to find the most intuitive way for users to adjust their LTV.

Dynamic LTV Adjustments: Users can customize their loan using a slider that adjusts either borrowed amount or collateral based on LTV

Outcome

Clear breakdown of LTV, hourly interest, and liquidation risk. Users see real-time cost estimates, APR, and LTV zones with color indicators—making it easy to understand borrowing impact and manage risk.

Designed a loan detail view with a card-style layout that presents all critical information at a glance. Users can see real-time LTV, risk, and cost breakdown, along with a timestamped loan history. Actions like repay and adjust collateral are always accessible, making it easy to manage loans confidently and transparently.

Manage Loans

Adjust Collateral

Designed a responsive UI that lets users adjust crypto loan collateral with immediate visual feedback. LTV and risk status update in real time based on user input, helping users understand the impact of their actions and manage risk with confidence.

Repay Loan

Designed a repay interface with clear breakdowns of principal, interest, and collateral return. We A/B tested several layout versions to ensure users could easily understand the impact of both partial and full repayments, resulting in a design that’s transparent, intuitive, and mobile-friendly.

Impact

66% of users who entered the flow completed a loan

7% of active users tried the loan feature within the first month

Early feedback highlighted clear LTV display and cost breakdown as most helpful